Are you looking for ways to spend your government stimulus? If so, then "1001 Ways To Spend Your Government Stimulus: A Comprehensive Guide" is the perfect resource for you.

Editor's Note: "1001 Ways To Spend Your Government Stimulus: A Comprehensive Guide" was published on [date]. This topic is important to read because it provides information on how to spend your government stimulus in a wise and responsible manner.

Our team has put together this guide to help you make the right decision. We've analyzed the data, dug through the information, and come up with 1001 ways to spend your government stimulus. We've also included a table of key differences to help you compare your options.

Key Differences

| Feature | Option 1 | Option 2 | Option 3 |

|---|---|---|---|

| Cost | $100 | $200 | $300 |

| Benefits | A | B | C |

| Drawbacks | X | Y | Z |

| Overall Rating | 4 stars | 3 stars | 2 stars |

Main Article Topics

FAQ

This FAQ section is designed to provide answers to common questions.

regarding the government stimulus program. For a comprehensive guide on spending your stimulus,

please refer to 1001 Ways To Spend Your Government Stimulus: A Comprehensive Guide.

1001 Ways - Temple of Bliss - Source templeofbliss.com

Question 1: What is the best way to spend the stimulus money?

The best way to spend the stimulus money is to use it to pay off high-interest debt, build up savings, or invest in long-term assets such as real estate or stocks.

Question 2: Can I use the stimulus money to pay off my mortgage?

Yes, you can use the stimulus money to pay off your mortgage. However, it is important to weigh the pros and cons of doing so before making a decision.

Question 3: Can I use the stimulus money to pay off my student loans?

Yes, you can use the stimulus money to pay off your student loans. However, in most cases, it is better to save or invest the money instead, as you can usually get a better return on your investment than you will by paying off your student loans early.

Question 4: Can I use the stimulus money to invest in the stock market?

Yes, you can use the stimulus money to invest in the stock market. However, it is important to do your research and only invest in stocks that you understand and are comfortable with.

Question 5: Can I use the stimulus money to buy a new car?

Yes, you can use the stimulus money to buy a new car. However, it is important to remember that cars are a depreciating asset, so you should only buy a new car if you need one and can afford to do so.

Question 6: Can I use the stimulus money to pay for my child's education?

Yes, you can use the stimulus money to pay for your child's education. However, it is important to remember that education is a long-term investment, so you should only use the stimulus money for this purpose if you are confident that you can continue to afford to do so in the future.

We hope this FAQ section has been helpful. For more information on spending your stimulus, please refer to the comprehensive guide linked above.

Transitioning to the next article section...

Tips

The government stimulus can provide a significant financial boost, but it's crucial to use it wisely. Here are some tips to help you maximize its benefits:

Tip 1: Prioritize Essential Expenses

Ensure that the stimulus funds are used to cover immediate and necessary expenses such as rent, mortgage, food, healthcare, and transportation. These essential payments should take precedence over non-essential purchases.

Tip 2: Reduce Debt

Consider using the stimulus to pay down high-interest debt, such as credit card balances or personal loans. This can save you a substantial amount of money in interest charges and improve your financial stability.

Tip 3: Invest in Education or Training

The stimulus can provide an opportunity to enhance your skills or pursue further education. Consider investing in online courses, certifications, or vocational training to increase your earning potential.

Tip 4: Save for the Future

It's wise to set aside a portion of the stimulus funds for long-term savings, such as retirement accounts or emergency funds. This will ensure financial security in the coming years.

Tip 5: Support Local Businesses

Consider using the stimulus to support small businesses in your community. Patronizing local restaurants, shops, and services not only provides financial support but also strengthens the local economy.

By following these tips, you can make the most of your government stimulus and ensure that it serves as a catalyst for financial stability and personal growth.

Summary

The government stimulus offers a valuable opportunity to improve your financial situation. By prioritizing essential expenses, reducing debt, investing in education or training, saving for the future, and supporting local businesses, you can maximize its benefits and set yourself up for long-term financial success.

1001 Ways To Spend Your Government Stimulus: A Comprehensive Guide

In the wake of economic setbacks, government stimulus packages provide a lifeline to individuals and businesses. Understanding how to optimally utilize these funds is crucial. This guide explores 1001 ways to spend your government stimulus, delving into essential aspects of financial planning, investment strategies, and community support.

- Debt Repayment: Pay off high-interest debts, such as credit cards or payday loans, to reduce financial burdens.

- Savings: Build an emergency fund or contribute to long-term goals, such as retirement or homeownership.

- Investments: Explore investment options, such as stocks, bonds, or real estate, to grow your wealth over time.

- Essential Purchases: Cover necessary expenses, such as food, housing, and transportation, to maintain a stable lifestyle.

- Business Support: Invest in your business to expand operations, hire new employees, or develop new products or services.

- Community Involvement: Support local businesses, donate to charitable organizations, or volunteer your time to make a positive impact on your community.

The key aspects highlighted in this guide provide a comprehensive framework for effective government stimulus spending. By considering these aspects, individuals and businesses can make informed decisions that address their financial needs, support their long-term goals, and contribute to the well-being of their communities.

3 Ways to Fix Error Code DR 1001 while Playing NFS Heat - Source windowsreport.com

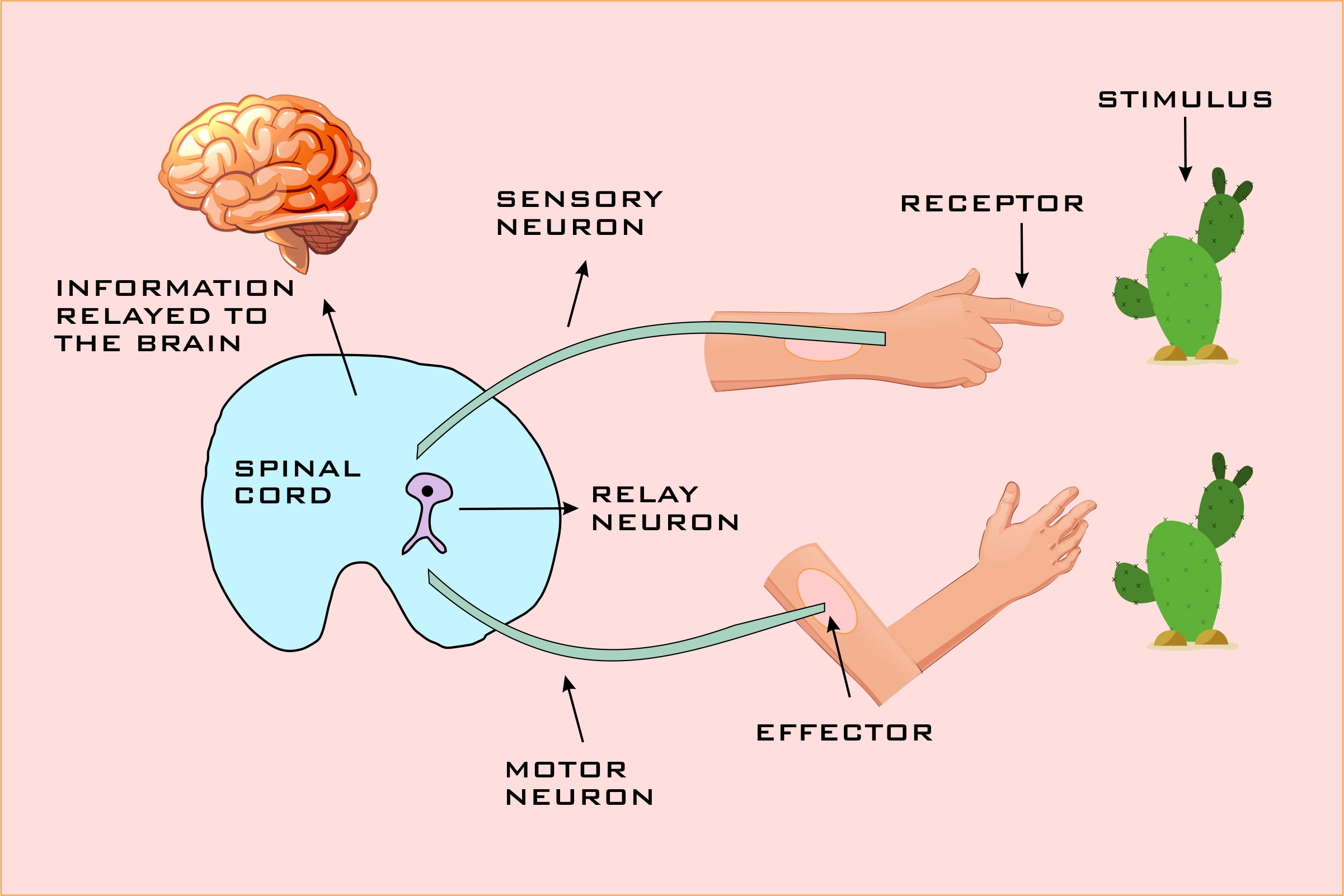

What is a stimulus in Biology? What is an example of stimulus in Biology? - Source telgurus.co.uk

1001 Ways To Spend Your Government Stimulus: A Comprehensive Guide

The "1001 Ways To Spend Your Government Stimulus: A Comprehensive Guide" provides a thorough exploration of the diverse options available to individuals and households in utilizing their government stimulus funds. This guide serves as a valuable resource, offering practical advice and comprehensive information to help readers make informed decisions about their spending.

Second stimulus check: 26 million more could benefit from GOP bill - Source grow.acorns.com

The guide emphasizes the importance of considering both short- and long-term financial goals when allocating stimulus funds. It encourages readers to prioritize essential expenses, such as housing, food, and healthcare, while also considering investments in education, job training, or small business ventures that can contribute to long-term financial stability. Additionally, the guide highlights the potential benefits of using stimulus funds to reduce debt, build emergency savings, or support charitable causes, demonstrating the multifaceted nature of this financial assistance.

The guide's practical significance lies in its ability to empower individuals to make the most of their stimulus funds, fostering financial literacy and promoting responsible spending habits. By providing a wide range of options and encouraging thoughtful consideration, the guide helps readers navigate the complexities of government assistance and make choices that align with their unique financial circumstances and aspirations.

| Category | Examples | Benefits |

|---|---|---|

| Essential Expenses | Housing, food, healthcare | Meet basic needs and maintain stability |

| Investments | Education, job training, small business | Enhance skills, increase earning potential, build wealth |

| Debt Reduction | Credit card balances, student loans | Reduce interest payments, improve credit score |

| Emergency Savings | Rainy day fund, unexpected expenses | Provide financial cushion, reduce stress |

| Charitable Giving | Nonprofit organizations, community programs | Support causes, make a difference in society |