Alcohol Tax in Dubai: A roadmap to navigate the ever-evolving complexities of the Alcohol Industry.

Editor's Notes: Alcohol Tax In Dubai: A Comprehensive Guide For Retailers And Consumers have published on

[Date]. And this has become a trending topic for the last few months, as alcohol consumption rates in Dubai continue to rise.

We understand the importance of staying up-to-date on this topic, which is why we've put together this guide to help you make informed decisions about alcohol consumption in Dubai.

Key differences between the old and new alcohol tax system in Dubai

| Old System | New System |

|---|---|

| 5% import duty | 30% import duty |

| 30% municipality tax | 50% municipality tax |

| No excise tax | 50% excise tax |

Transition to main article topics

FAQ

This FAQ section provides answers to common questions about alcohol tax in Dubai. Alcohol Tax In Dubai: A Comprehensive Guide For Retailers And Consumers For more in-depth information, please refer to the comprehensive guide.

How New Alcohol Tax Laws May Affect Your Business | SevenFifty Daily - Source daily.sevenfifty.com

Question 1: What is the legal drinking age in Dubai?

The legal drinking age in Dubai is 21 years old.

Question 2: How much is the alcohol tax in Dubai?

The alcohol tax in Dubai is 50% of the retail price.

Question 3: Can I bring alcohol into Dubai from another country?

Yes, you can bring up to 4 liters of alcohol into Dubai from another country without paying any tax. However, you must declare the alcohol to customs upon arrival.

Question 4: Where can I buy alcohol in Dubai?

You can buy alcohol at licensed retail stores and restaurants in Dubai.

Question 5: What are the penalties for drinking alcohol in public in Dubai?

The penalties for drinking alcohol in public in Dubai include fines and imprisonment.

Question 6: What are the penalties for driving under the influence of alcohol in Dubai?

The penalties for driving under the influence of alcohol in Dubai include fines, imprisonment, and deportation.

This FAQ section has summarized the key information about alcohol tax in Dubai. For more details, please consult the comprehensive guide.

For further inquiries or assistance, please refer to the designated authorities in Dubai.

Tips

To ensure compliance with Dubai's alcohol tax regulations and maintain responsible alcohol sales, retailers and consumers should consider the following tips:

Tip 1: Obtain the Necessary Licenses and Permits

Establishments selling alcoholic beverages in Dubai must obtain a valid alcohol license and permit from the Dubai Municipality. This license is essential for legal and compliant alcohol sales.

Tip 2: Display Alcohol Prices Clearly

Legibly display alcohol prices, including the alcohol tax, for consumers to make informed purchasing decisions. This pricing transparency helps prevent any disputes or misunderstandings.

Tip 3: Train Employees on Alcohol Regulations

Retailers should thoroughly educate their staff on the Emirates Alcohol Law and Dubai's alcohol tax regulations. Ensuring employee knowledge helps prevent underage sales, intoxication, and other legal issues.

Tip 4: Maintain Accurate Inventory Records

To comply with tax authorities, retailers must maintain detailed inventory records of all alcoholic beverages in stock. These records should include purchase invoices, sales receipts, and any stock adjustments.

Tip 5: Stay Updated with Legal Changes

Alcohol tax regulations and laws are subject to changes. Retailers and consumers should regularly monitor official sources for any updates or amendments to stay compliant and informed.

Tip 6: Encourage Responsible Alcohol Consumption

Both retailers and consumers have a responsibility to promote responsible alcohol consumption. Retailers can display warning signs, limit sales to intoxicated individuals, and offer non-alcoholic beverage options.

Summary:

Following these tips can ensure that retailers and consumers operate within the legal framework governing alcohol sale and consumption in Dubai. By staying informed, adhering to regulations, and promoting responsible alcohol practices, a safe and compliant alcohol environment can be maintained.

Alcohol Tax In Dubai: A Comprehensive Guide For Retailers And Consumers

Alcohol tax in Dubai is a complex topic, with several key aspects that retailers and consumers must be aware of. These include the type of tax levied, the rate of tax, the method of calculation, and the exemptions and concessions available.

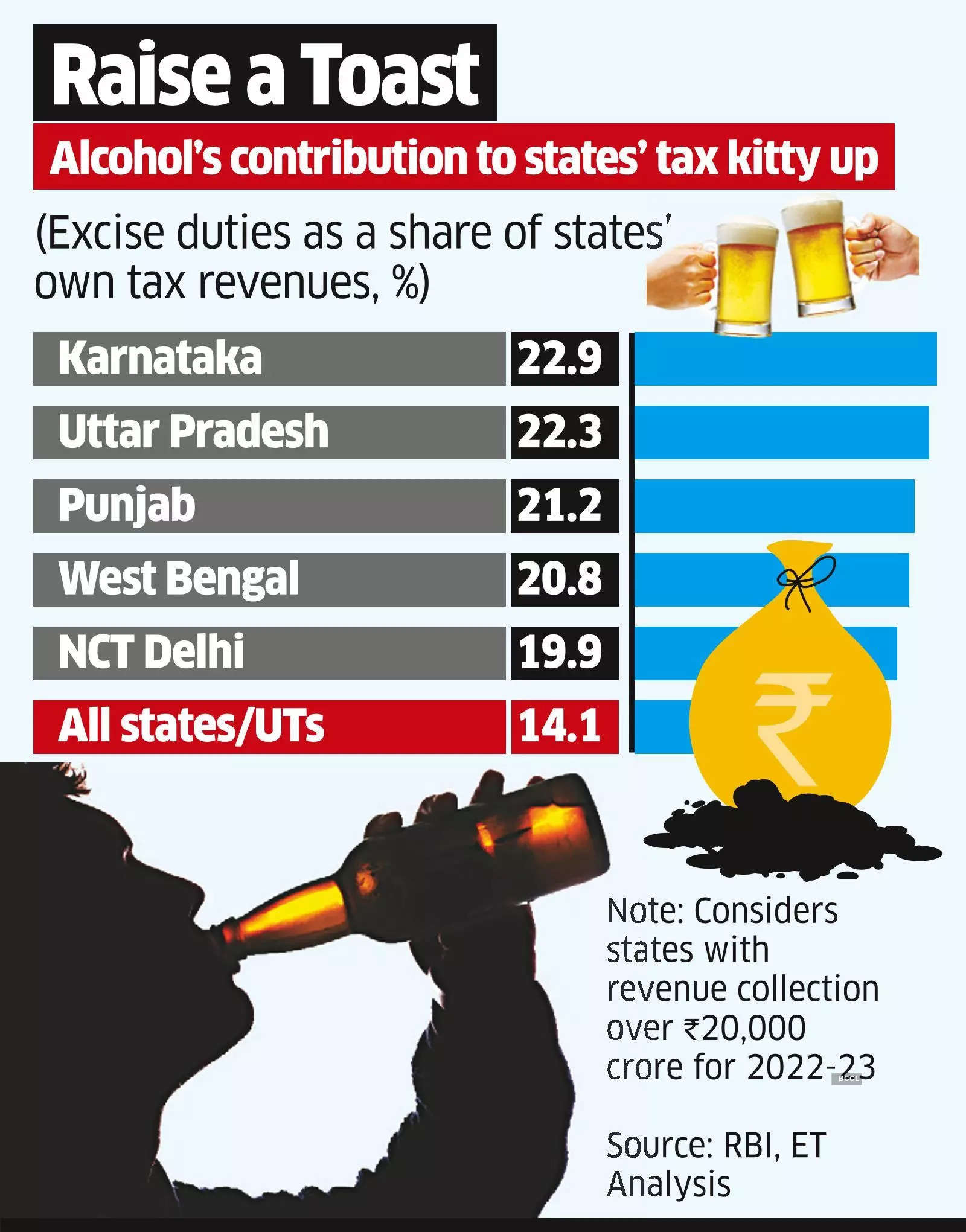

Share of alcohol on rise in states' tax revenue kitty - The Economic Times - Source economictimes.indiatimes.com

- Type of Tax: Excise Tax

- Tax Rate: 50%

- Calculation: Ad Valorem

- Exemptions: Duty-free shops and tourists with valid permits

- Concessions: None

Understanding these aspects is crucial for retailers to ensure compliance with tax regulations and for consumers to make informed decisions about alcohol purchases. The excise tax in Dubai is a significant source of revenue for the government, and retailers must accurately calculate and remit the tax on all alcohol sales. Consumers, on the other hand, must be aware of the tax implications and the exemptions and concessions available to them.

Doubling alcohol tax could have prevented 5,000 cancer deaths in Europe - Source www.newfoodmagazine.com

Alcohol Tax In Dubai: A Comprehensive Guide For Retailers And Consumers

Understanding the alcohol tax in Dubai is crucial for both retailers and consumers. The tax, imposed by the Dubai government, affects the pricing and availability of alcoholic beverages in the emirate. This guide provides comprehensive information on the alcohol tax in Dubai, including its rates, regulations, and implications for businesses and individuals.

Addiction Inbox: Tripling the Tax on Alcohol - Source addiction-dirkh.blogspot.com

The alcohol tax in Dubai is a significant revenue source for the government. It is also a means of controlling the consumption of alcohol in the emirate. The tax rates vary depending on the type of alcoholic beverage, with higher rates for stronger drinks. Retailers are required to obtain a license from the Dubai Department of Economic Development to sell alcohol. They must also comply with strict regulations regarding the storage, transportation, and sale of alcoholic beverages.

Consumers should be aware of the alcohol tax when purchasing alcoholic beverages in Dubai. The tax is included in the price of the beverage, so it is essential to factor it into your budget. It is also important to be aware of the legal drinking age in Dubai, which is 21 years old. Drinking alcohol in public places is prohibited, and violators may face fines or imprisonment.

The alcohol tax in Dubai is a complex issue with implications for both businesses and consumers. By understanding the tax rates, regulations, and implications, retailers and consumers can make informed decisions about the purchase and consumption of alcoholic beverages in the emirate.

Table: Alcohol Tax Rates in Dubai

| Type of Beverage | Tax Rate |

|---|---|

| Beer | 30% |

| Wine | 30% |

| Spirits | 50% |

Conclusion

The alcohol tax in Dubai is a complex and multifaceted issue. It affects both businesses and consumers in the emirate. By understanding the tax rates, regulations, and implications, stakeholders can make informed decisions about the purchase and consumption of alcoholic beverages in Dubai.

The government of Dubai is committed to regulating the alcohol industry in a way that balances revenue generation with social responsibility. The alcohol tax is one of several measures that the government has implemented to achieve this goal.