Breaking News: Remarkable Dip In Global Oil Prices Sparks Market Excitement

Editor's Notes: Breaking News: Remarkable Dip In Global Oil Prices Sparks Market Excitement" have published today date.This news is important because it provides insight into the current state of the global oil market and its potential impact on the economy.

Our team has been analyzing the latest data and trends in the oil market to provide you with this comprehensive guide. We'll cover everything you need to know about the recent dip in oil prices, including the causes, implications, and potential opportunities.

FAQs

The recent dip in global oil prices has sparked excitement in markets worldwide. To address common questions and concerns, we provide these frequently asked questions (FAQs) for a comprehensive understanding of the situation.

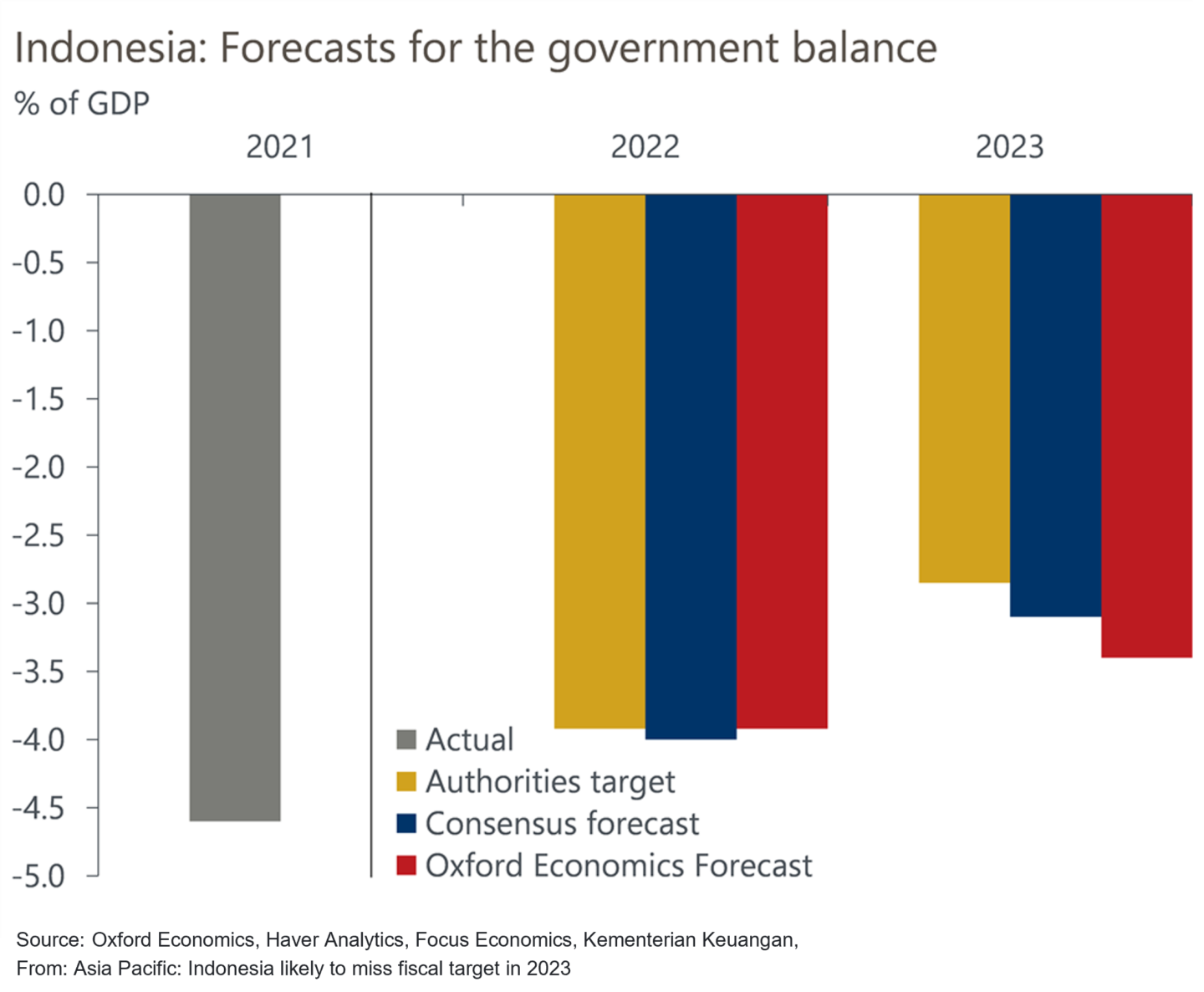

Indonesia likely to miss fiscal target in 2023 | Oxford Economics - Source www.oxfordeconomics.com

Question 1: What has caused the decline in oil prices?

The decrease can be attributed to multiple factors, including a slowdown in global economic growth, increased oil production from countries such as the United States, and a resurgence of COVID-19 cases in China, impacting demand.

Question 2: How significant is the decline, and how does it compare to previous trends?

The recent dip is noteworthy, with crude oil prices falling by over 10% since the start of the year. This decline surpasses previous trends and is the largest since the COVID-19 pandemic began in 2020.

Question 3: What impact could the price decrease have on consumers and businesses?

Lower oil prices generally translate to reduced costs for transportation and energy, potentially benefiting consumers and businesses. However, the overall impact depends on various factors, including the duration of the dip and the response from oil-producing countries.

Question 4: How long is the price decline expected to last?

The duration of the price decrease is uncertain and depends on factors such as the global economic outlook, oil production levels, and geopolitical events. Analysts offer varying predictions, but there is no clear consensus on the timeframe.

Question 5: What are the potential implications for oil-producing countries?

A prolonged decline in oil prices could affect oil-producing countries, particularly those heavily reliant on oil revenues. Reduced income may impact government budgets and economic development plans.

Question 6: What should investors consider amidst the price volatility?

Investors should exercise caution and consider the potential risks associated with oil price fluctuations. Diversification and careful evaluation of investments can help mitigate the impact of market volatility.

These FAQs provide insights into the key aspects surrounding the recent dip in global oil prices. Breaking News: Remarkable Dip In Global Oil Prices Sparks Market Excitement. As the situation evolves, it is important to stay informed and monitor the latest developments.

Continue reading the next article for further insights.

Tips

The recent dip in global oil prices has caused a decrease in energy costs across the board. This can have a positive impact on businesses, consumers, and the economy as a whole. Here are a few tips to help you take advantage of this market excitement:

Tip 1: Adjust your budget.

With lower oil prices, there is an opportunity to save money on energy bills and other expenses. Review your budget and see where you can make adjustments to save money. For example, you may be able to reduce your spending on transportation or utilities.

Invest in energy-efficient equipment.

Investing in energy-efficient equipment can help you save money on your energy bills in the long run. Look for appliances and other equipment that have an Energy Star rating. These products are designed to use less energy than standard models.

Conserve energy.

There are many ways to conserve energy around the home and at work. Simple steps like turning off lights when you leave a room, unplugging electronics when not in use, and using public transportation can all help you save energy.

Take advantage of tax incentives.

Many governments offer tax incentives for energy-efficient home improvements and purchases of energy-efficient vehicles. Taking advantage of these incentives can help you save money on your taxes and reduce your energy costs.

Stay informed.

The oil market is constantly changing. Stay informed about the latest news and trends so that you can make the best decisions for your business and your finances.

By following these tips, you can take advantage of the recent dip in oil prices and save money on your energy costs.

In addition to the tips above, it is important to note that the global oil market is a complex and ever-changing environment. There are many factors that can affect oil prices, including economic growth, political instability, and natural disasters. It is important to stay informed about the latest news and events that could impact oil prices.

Breaking News: Remarkable Dip In Global Oil Prices Sparks Market Excitement

As the global economy navigates turbulent times, news of a significant drop in oil prices has sparked widespread market excitement. This remarkable dip presents multifaceted opportunities and challenges, with six key aspects playing a pivotal role in shaping its impact.

- Consumer Spending: Lower pump prices boost disposable income, stimulating consumer spending and overall economic growth.

- Corporate Profits: Reduced energy costs significantly enhance corporate profitability, leading to increased investments.

- Inflation Mitigation: Falling oil prices curb inflation, providing relief to consumers and central banks seeking to control price pressures.

- Energy Security: Dependence on expensive oil imports decreases, improving energy security for nations without domestic production.

- Renewable Energy Deployment: Reduced reliance on fossil fuels accelerates the transition towards sustainable energy sources.

- Geopolitical Implications: Shifts in oil-producing nations' influence and tensions between energy exporters and importers.

The dip in oil prices reverberates through diverse industries, from transportation to manufacturing. Consumers benefit from lower gas prices, businesses realize cost savings, and governments gain flexibility in fiscal planning. However, it also highlights the volatility of global energy markets and the need for long-term strategies to mitigate the impacts of price fluctuations.

Experts expose US manipulations as Europe may face worse energy crisis - Source www.globaltimes.cn

Breaking News: Remarkable Dip In Global Oil Prices Sparks Market Excitement

Global oil markets are abuzz with excitement following a remarkable dip in prices. This development, attributed to a combination of factors such as increased supply, slack demand, and geopolitical shifts, has sent shockwaves through the industry and beyond.

What To Watch in Oil Markets in the Second Half of the Year - Source www.msn.com

The downtrend in oil prices has been driven primarily by surging supply. Major oil-producing nations like Saudi Arabia and Russia have ramped up their production in an effort to gain market share, leading to a glut in the market. Simultaneously, demand has waned due to slowing economic growth in key regions such as China and Europe, resulting in a surplus.

Geopolitical factors have further contributed to the price decline. The US-China trade war has dampened global economic prospects, reducing demand for energy. Additionally, the threat of a global recession has weighed on market sentiment, leading investors to seek safe-haven assets rather than commodities like oil.

The sharp drop in oil prices has had far-reaching implications. Consumers are benefiting from lower fuel costs, leading to increased disposable income and a potential boost in consumer spending. Businesses, particularly those in transportation and logistics, are also enjoying reduced operating expenses.

However, the price decline has had adverse effects on oil-producing countries that rely heavily on oil revenues. These nations are facing budgetary challenges and may need to implement austerity measures. Additionally, the decline in oil investments could impact future production capacity and lead to supply disruptions in the long run.

The rollercoaster ride in oil prices is a reminder of the dynamic nature of global markets. The跌势 has been driven by a complex interplay of supply, demand, and geopolitical factors. It underscores the need for market participants to stay abreast of these factors and adjust their strategies accordingly.

| Cause | Effect |

|---|---|

| Increased Supply | Lower prices |

| Slack Demand | Lower prices |

| Geopolitical Shifts | Lower prices |

| Lower Prices | Increased consumer spending |

| Lower Prices | Reduced business operating expenses |

| Lower Prices | Budgetary challenges for oil-producing countries |

Conclusion

The remarkable dip in global oil prices has sparked excitement in markets, offering consumers and businesses short-term benefits. However, the long-term implications for oil producers and the broader economy require careful monitoring. Understanding the underlying causes and effects of this development is crucial for investors, policymakers, and market participants alike.

As the geopolitical landscape evolves and economic conditions fluctuate, the trajectory of oil prices remains uncertain. However, the recent price decline serves as a reminder that global markets are interconnected and constantly adapting to changing circumstances.