PKB: Enhancing Financial Resilience for Individuals and Businesses, a groundbreaking initiative, has been making waves in the financial arena. This comprehensive guide empowers individuals and businesses alike to navigate the complexities of financial planning and achieve long-term financial resilience.

Editor's Notes: Published today, PKB: Enhancing Financial Resilience For Individuals And Businesses tackles the paramount importance of financial resilience in today's dynamic economic climate.

Through rigorous analysis and data-driven insights, our team has meticulously crafted this guide, offering a roadmap towards financial security. Whether you're an individual seeking to secure your financial future or a business looking to bolster your financial foundation, this guide provides invaluable tools and strategies.

Key Differences

| PKB: Enhancing Financial Resilience For Individuals And Businesses | Traditional Financial Planning |

|---|---|

| Focuses on long-term resilience and sustainability | Primarily addresses current financial needs |

| Comprehensive approach, encompassing personal and business finances | Often compartmentalizes personal and business financial planning |

| Data-driven insights and evidence-based strategies | May rely on subjective or anecdotal advice |

Main Article Topics

FAQ

This FAQ section provides responses to frequently asked questions about the topic of financial resilience for individuals and businesses, as discussed in the PKB: Enhancing Financial Resilience For Individuals And Businesses.

Simple Innovation Helps Rural Communities in Ghana Improve Latrine - Source globalcommunities.org

Question 1: What is financial resilience, and why is it important for individuals and businesses?

Financial resilience refers to the ability to withstand and recover from financial shocks or setbacks. It is crucial because unexpected events can disrupt financial stability, leading to significant challenges for individuals and businesses

Question 2: How can individuals improve their financial resilience?

Building financial resilience involves establishing sound financial habits, creating an emergency fund, diversifying investments, and managing debt effectively.

Question 3: What strategies can businesses adopt to enhance financial resilience?

Businesses can enhance financial resilience by maintaining ample cash flow, diversifying revenue streams, establishing strong relationships with financial institutions, and implementing risk management strategies.

Question 4: What are the benefits of financial resilience for individuals and businesses?

Financial resilience provides a sense of security, reduces stress, protects against unexpected expenses, and enables individuals and businesses to seize opportunities during challenging times.

Question 5: What are some common misconceptions about financial resilience?

One common misconception is that financial resilience is only for wealthy individuals or large corporations. In reality, everyone can benefit from building financial resilience.

Question 6: Where can individuals and businesses find resources and support to enhance their financial resilience?

Numerous resources are available to support individuals and businesses in building financial resilience. These include financial literacy programs, credit counseling agencies, government assistance programs, and financial planning services.

Financial resilience is essential for navigating an increasingly uncertain economic landscape. By understanding the key principles and adopting sound strategies, individuals and businesses can enhance their financial well-being and mitigate the impact of unforeseen challenges.

Learn more about the importance of financial resilience and explore practical strategies for individuals and businesses in our article, PKB: Enhancing Financial Resilience For Individuals And Businesses.

Tips

In striving for financial resilience, there are key practical strategies that individuals and businesses can adopt to enhance their financial well-being. These tips offer guidance on effective approaches:

Tip 1: Build an Emergency Fund

An emergency fund acts as a safety net for unexpected expenses, preventing the need to rely on debt. Aim to set aside 3-6 months' worth of living expenses in a liquid account.

Tip 2: Reduce Unnecessary Expenses

Evaluate spending habits to identify areas where non-essential expenses can be cut. Consider negotiating lower bills, switching to generic brands, or exploring cost-saving alternatives.

Tip 3: Increase Income Streams

Diversify income sources by exploring side hustles, part-time work, or rental properties. This can provide an additional buffer against financial shocks.

Tip 4: Manage Debt Wisely

Prioritize paying down high-interest debts first and consider debt consolidation or refinancing options to reduce interest rates. Seek professional advice if struggling with debt repayment.

Tip 5: Save for Retirement

Start saving for retirement as early as possible. Take advantage of employer-sponsored plans and consider individual retirement accounts. Retirement savings can provide financial security in later years.

Tip 6: Seek Professional Advice

Financial advisors can provide personalized guidance and support in developing and implementing financial plans tailored to specific goals and circumstances.

Tip 7: Stay Informed

Stay up-to-date on financial news and trends. By understanding economic conditions and financial instruments, individuals can make informed decisions that support their financial resilience.

By embracing these tips, individuals and businesses can strengthen their financial resilience and navigate financial challenges with greater confidence.

PKB: Enhancing Financial Resilience For Individuals And Businesses

Personal and business financial resilience are key elements of a stable economy and society. Promoting financial resilience is the primary mandate of the PKPB (Pembiayaan Kecil Perniagaan Bank or Bank Small Business Financing) in Malaysia. This is achieved by delivering financial assistance, advisory services, and training programs that aim to enhance the financial knowledge and capability of individuals and businesses.

- Financial Education: PKPB provides financial literacy programs to individuals and small business owners, covering topics such as budgeting, credit management, and investment strategies.

- Access to Credit: PKPB offers a range of financing options, including micro-loans, business loans, and equity financing, tailored to the specific needs of individuals and businesses.

- Business Advisory Services: PKPB provides free business advisory services through a network of business advisors, offering support with business planning, marketing, and operations management.

- Risk Management: PKPB promotes risk management practices among individuals and businesses, helping them identify and mitigate potential financial risks.

- Financial Planning: PKPB encourages individuals and businesses to engage in financial planning, emphasizing the importance of setting financial goals, budgeting, and saving for the future.

- Entrepreneurship Development: PKPB supports entrepreneurship development through training programs, mentorship initiatives, and access to financing, fostering the growth of new businesses and job creation.

These key aspects of PKPB's work collectively contribute to enhancing the financial resilience of individuals and businesses. By providing access to financial knowledge, credit, advisory services, and risk management tools, PKPB empowers individuals and businesses to make informed financial decisions, manage their finances effectively, and withstand financial shocks. This fosters a more stable and resilient financial system that supports economic growth and prosperity.

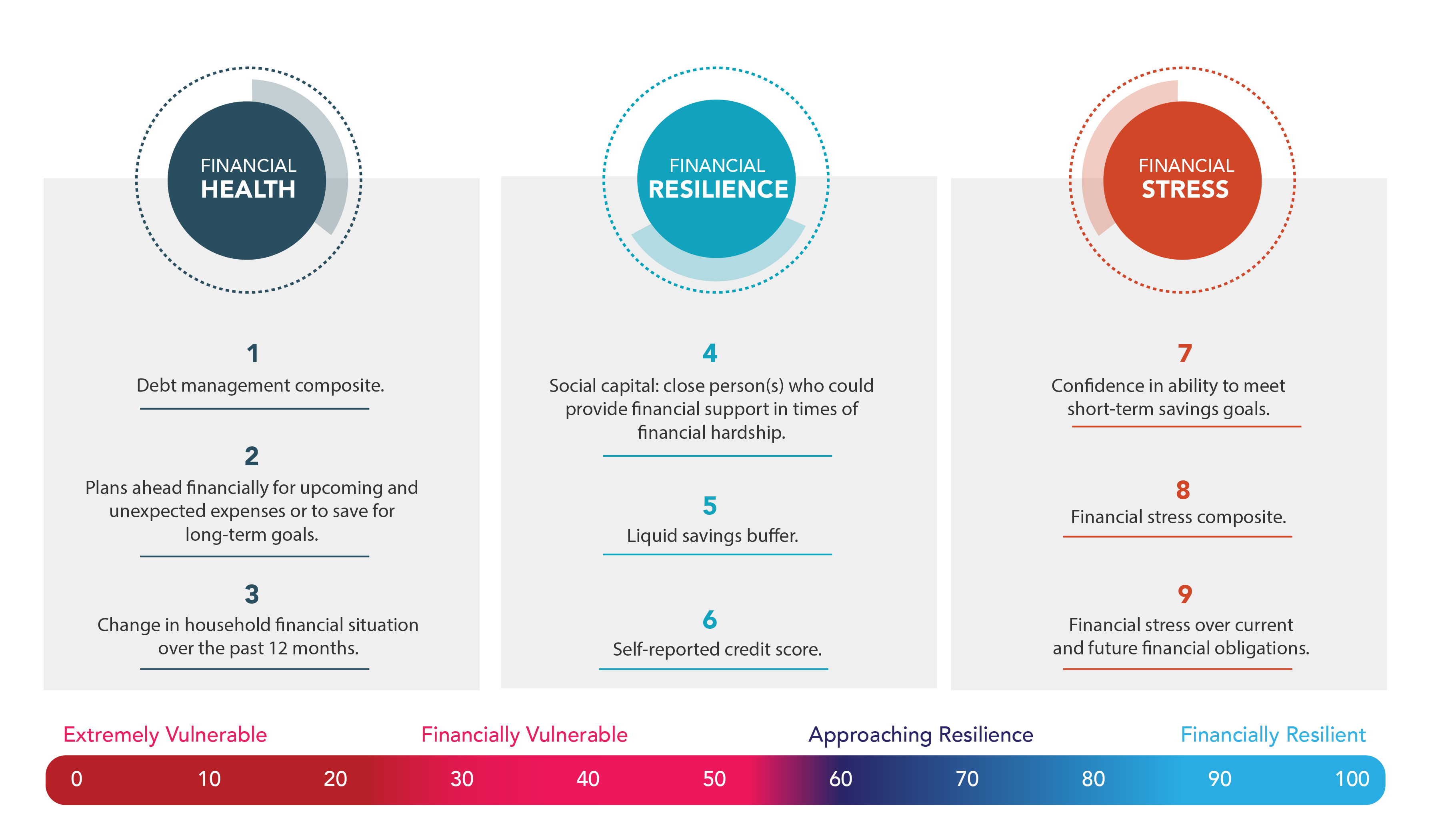

Indicators & Scoring Model | Financial Resilience Institute - Source www.finresilienceinstitute.org

PKB: Enhancing Financial Resilience For Individuals And Businesses

PKB, or Prakarsa Keuangan Berkeadilan (Initiative for Fair Finance), is a government program in Indonesia aimed at promoting financial inclusion and resilience among individuals and businesses. A key aspect of PKB is the provision of financial literacy and education, which empowers individuals and business owners with the knowledge and skills to manage their finances effectively. This, in turn, contributes to greater financial resilience, which is the ability to withstand and recover from financial shocks or unexpected events.

Key Recommendations: Building Financial Resilience to Climate Impacts - Source issuu.com

Financial resilience is crucial for both individuals and businesses. For individuals, it means having a stable income, managing debt responsibly, and saving for the future. For businesses, it involves maintaining healthy cash flow, diversifying revenue streams, and managing risk effectively. By enhancing financial resilience, PKB contributes to the overall economic stability and growth of communities.

One of the key challenges in promoting financial resilience is the lack of financial literacy among many individuals and business owners. PKB addresses this challenge by providing a range of financial education programs, including workshops, seminars, and online resources. These programs cover topics such as budgeting, saving, investing, and managing debt. By increasing financial literacy, PKB empowers individuals and businesses to make informed financial decisions and take control of their financial well-being.

PKB has a significant impact on the lives of individuals and businesses. For example, a study by the World Bank found that participants in PKB's financial literacy programs experienced a 20% increase in savings and a 15% decrease in debt. These improvements in financial well-being contribute to greater economic resilience and stability for both individuals and the community as a whole.

Table: Key Insights on PKB's Role in Enhancing Financial Resilience

| Key Insight | Explanation |

|---|---|

| Financial literacy is essential for financial resilience. | Individuals and businesses with higher financial literacy are better equipped to make informed financial decisions and manage their finances effectively. |

| PKB provides a range of financial education programs. | These programs empower individuals and businesses with the knowledge and skills they need to improve their financial resilience. |

| PKB has a positive impact on financial well-being. | Studies have shown that participants in PKB's programs experience increased savings, decreased debt, and improved financial decision-making. |

Conclusion

PKB plays a vital role in enhancing financial resilience for individuals and businesses in Indonesia. By providing financial literacy and education, PKB empowers individuals and businesses to make informed financial decisions, manage their finances effectively, and withstand financial shocks. The positive impact of PKB on financial well-being contributes to the overall economic stability and growth of communities.

Looking ahead, it is important to continue to support and expand PKB's financial literacy programs. By investing in financial education, we can create a more financially resilient society that is better equipped to navigate the challenges of the future.