Yatırımcıların bilinçli kararlar verebilmelerine yardımcı olmak için, mevcut piyasa performansını, yatırımcı görünümünü ve çimento hisselerinin geleceğine ilişkin beklentileri dikkatlice inceledik. Bu kapsamlı kılavuzumuzda, okuyucular aşağıdakiler de dahil olmak üzere çeşitli konularda değerli bilgiler bulacaklardır:

- Çimento endüstrisinin genel görünümü

- Çimento şirketlerinin finansal performansı

- Çimento sektörünü etkileyen mevcut trendler

- Gelecekte çimento hisselerinin potansiyel büyüme alanları

Çimento Hisseleri: Piyasa Performansı, Yatırımcı Görünümü Ve Gelecek Beklentileri, bu yatırım türüyle ilgilenen herkes için bir zorunluluktur. Okumaya devam ederek, bilinçli kararlar verebilmek için ihtiyaç duyduğunuz bilgi ve içgörüleri edineceksiniz.

FAQ

This comprehensive FAQ section aims to delve into the various aspects surrounding Çimento Hisseleri: Piyasa Performansı, Yatırımcı Görünümü Ve Gelecek Beklentileri. Deriving insights from the article, it presents answers to commonly raised queries, offering a deeper understanding of the topic.

Question 1: How have cement stocks performed in the recent market?

Question 2: What is the current investor sentiment towards cement stocks?

Question 3: What factors are likely to influence cement stock prices in the future?

Question 4: Are there any specific opportunities or risks associated with investing in cement stocks?

Question 5: How do cement stock valuations compare to other sectors?

Question 6: What key indicators should investors monitor to stay informed about cement stock performance?

This FAQ section has explored the intricate facets of investing in cement stocks, offering insights into market dynamics, investor sentiment, and potential future trends. By staying updated on industry news and economic indicators, investors can make informed decisions about their investments in cement stocks.

Tips

In assessing and investing in cement stocks, consider these tips to enhance your decision-making:

1. Analyze the macroeconomy: Monitor economic indicators such as GDP growth, construction activity, and interest rates to gauge the industry's overall health and potential growth drivers.

2. Evaluate industry dynamics: Research cement industry trends, including competition, supply and demand balance, and technological advancements to identify potential risks and opportunities.

3. Assess company fundamentals: Scrutinize financial performance, operating efficiency, and management effectiveness of potential investment targets. Consider revenue growth, profitability, and debt levels.

4. Consider market dynamics: Monitor stock prices, trading volumes, and analyst ratings to gauge market sentiment towards the sector and individual companies.

5. Monitor government regulations: Keep abreast of changes in environmental, construction, and tax regulations that may impact the industry and specific companies.

Key Takeaways: By following these tips, investors can increase their understanding of the cement industry, make informed investment decisions, and potentially benefit from its growth opportunities.

Çimento Hisseleri: Market Performance, Investor Outlook, Future Expectations

The performance of cement stocks is determined by a combination of factors that need to be thoroughly analyzed by investors to develop a sound understanding and make informed decisions. Here are six key aspects that shape the market performance of cement stocks and provide insights into the future outlook for investors:

- Economic Growth: Strong economic growth drives demand for cement as it supports construction activities.

- Infrastructure Development: Government investments in infrastructure projects create a positive demand outlook.

- Competitive Landscape: Competition from domestic and international producers influences market share and pricing power.

- Raw Material Costs: Fluctuations in the prices of raw materials, such as limestone and coal, impact production costs.

- Environmental Regulations: Growing emphasis on sustainability and emission reduction affects production processes and costs.

- Investor Sentiment: Market sentiment and expectations about the future performance of the industry influence stock prices.

By understanding these key aspects and their dynamic interactions, investors can evaluate the market performance of cement stocks and make informed decisions. A thorough analysis of demand drivers, competitive dynamics, and potential risks allows investors to identify opportunities and assess the long-term growth potential of cement stocks.

itopya.com on Twitter: "Serin çalışma performansı, sade ve şık görünümü - Source twitter.com

Çimento Hisseleri: Piyasa Performansı, Yatırımcı Görünümü Ve Gelecek Beklentileri

The performance of cement stocks in the market is closely tied to the demand for cement, which in turn is driven by the construction industry. When the construction industry is booming, demand for cement increases, leading to higher prices and increased profits for cement companies. As a result, cement stocks tend to perform well during periods of economic growth. Conversely, when the construction industry is in a downturn, demand for cement decreases, leading to lower prices and decreased profits for cement companies. As a result, cement stocks tend to perform poorly during periods of economic recession.

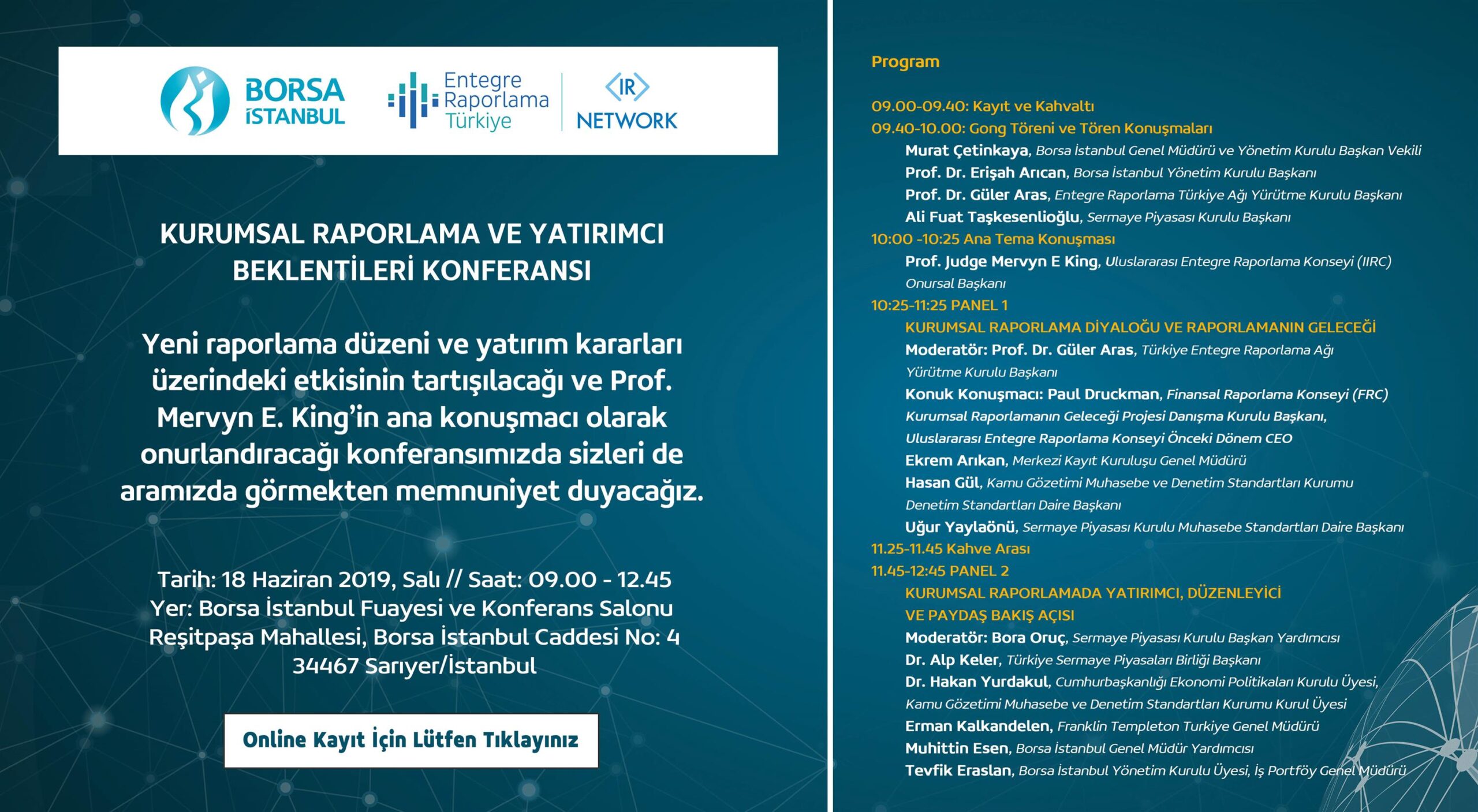

Kurumsal Raporlama ve Yatırımcı Beklentileri Konferansı, 18 Haziran - Source www.tkyd.org

Investors' outlook on cement stocks is also influenced by the future prospects of the construction industry. If investors believe that the construction industry is poised for growth, they are more likely to invest in cement stocks. Conversely, if investors believe that the construction industry is facing challenges, they are less likely to invest in cement stocks.

The future expectations for cement stocks are based on a number of factors, including the expected growth of the construction industry, the competitive landscape of the cement industry, and the overall economic outlook.

Table: Factors Affecting the Performance of Cement Stocks

| Factor | Impact on Cement Stocks |

|---|---|

| Demand for cement | Higher demand leads to higher prices and increased profits |

| Construction industry outlook | Positive outlook leads to increased investment in cement stocks |

| Competitive landscape | Increased competition can lead to lower prices and decreased profits |

| Overall economic outlook | Economic growth leads to increased demand for cement |