Why Is Bitcoin Falling: Reasons And Potential Implications

3 Reasons Why Bitcoin Could Retrace Back to ,000 This Week - Source gameofsatoshi.blogspot.com

Why Is Bitcoin Falling: Reasons And Potential Implications

Editor's Notes:

To help you understand the reasons behind this decline and its potential implications, our team has done extensive research, analyzed market data, and consulted with industry experts. This comprehensive guide explores the key factors contributing to Bitcoin's price drop and discusses the potential consequences for investors and the cryptocurrency market as a whole.

Key Differences or Key Takeaways:

|---|---|

Transition to main article topics:

FAQ

Why Is Bitcoin Falling: Reasons And Potential Implications

3 Reasons Why Bitcoin Could Test ,000 - Source www.cryptohopper.com

Question 1:

Tips

Understanding the factors influencing Bitcoin's price fluctuations can empower investors to make informed decisions and navigate market volatility effectively.

Tip 1: Stay Informed about Market News and Regulatory Developments:

Keeping up with industry news, government policies, and industry developments can provide valuable insights into potential catalysts for Bitcoin's price movements.

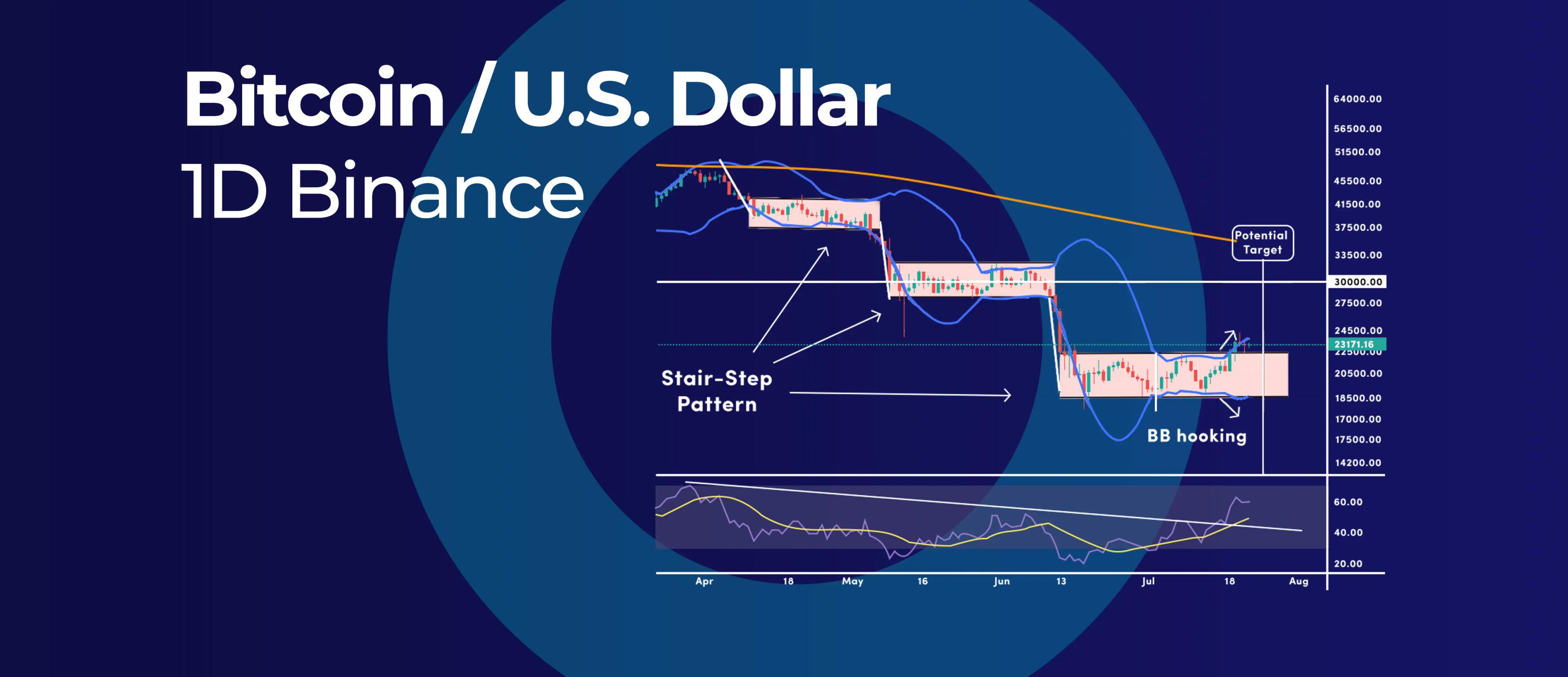

Tip 2: Monitor Technical Indicators:

Technical indicators, such as moving averages, support and resistance levels, and stochastic oscillators, can assist in identifying market trends and potential turning points.

Tip 3: Consider Economic Factors:

Economic conditions, including inflation, interest rates, and global economic growth, can influence investor sentiment and affect Bitcoin's performance.

Tip 4: Diversify Your Portfolio:

Allocating a portion of your investment portfolio to Bitcoin and other cryptocurrencies can reduce risk and potentially enhance returns.

Tip 5: Set Realistic Expectations:

Bitcoin's price movements can be unpredictable. Setting realistic expectations and avoiding emotional decision-making during market volatility is crucial.

These tips provide a framework for navigating the complex factors influencing Bitcoin's price fluctuations, allowing individuals to make informed decisions and manage their investments effectively.

Remember, investing in any asset class, including Bitcoin, involves inherent risk. Therefore, conducting thorough research and seeking professional advice, when necessary, is highly recommended before making any investment decisions.

Why Is Bitcoin Falling: Reasons And Potential Implications

The recent decline in Bitcoin's value has raised concerns and sparked discussions about the reasons behind this fall and its potential implications. This article delves into six key aspects that contribute to Bitcoin's price drop, exploring various dimensions related to this topic.

- Regulatory Uncertainties: Increased regulatory scrutiny and potential bans in certain countries have created uncertainty among investors.

- Competition From Altcoins: The emergence of alternative cryptocurrencies (altcoins) has increased competition and diverted investment away from Bitcoin.

- Market Manipulation: Allegations of large-scale market manipulation and wash trading have shaken investor confidence.

- Economic Slowdown: Macroeconomic factors, such as rising interest rates, inflation, and global economic uncertainty, have dampened investor appetite for risky assets.

- Technological Limitations: Bitcoin's scalability and transaction speed limitations have hindered its wider adoption as a payment method.

- Environmental Concerns: The energy-intensive mining process of Bitcoin has raised environmental concerns, potentially affecting its long-term sustainability.

These key aspects highlight the complex interplay of regulatory, competitive, economic, and technological factors that have contributed to Bitcoin's decline. The implications of this fall range from reduced investor confidence to potential regulatory clampdowns. However, Bitcoin's long-term prospects remain uncertain, and its future trajectory will depend on the resolution of these issues and the broader adoption of cryptocurrencies.

عملة بيتكوين تقفز فوق 10000 دولار | البوابة العربية للأخبار التقنية - Source aitnews.com

Why Is Bitcoin Falling: Reasons And Potential Implications

Bitcoin has been on a downward trend since its all-time high in November 2021. There are a number of reasons for this, including:

Why Are My Lash Extensions Falling Out & How to Fix It - Source divinelashes.ca

• Interest rate hikes: The Federal Reserve has been raising interest rates in an effort to combat inflation. This has made it more expensive for people to borrow money, which has led to a decrease in demand for Bitcoin and other cryptocurrencies.

• Regulatory uncertainty: There is still a lot of uncertainty about how governments will regulate Bitcoin and other cryptocurrencies. This has made some investors hesitant to invest in these assets.

• Competition from other cryptocurrencies: There are a number of other cryptocurrencies that are competing with Bitcoin for market share. This has led to a decrease in demand for Bitcoin.

The potential implications of Bitcoin's decline are significant. If Bitcoin continues to lose value, it could lead to a loss of confidence in the cryptocurrency market. This could lead to a decrease in investment in cryptocurrencies, which could in turn lead to a further decline in prices.

It is important to note that Bitcoin is a volatile asset, and its price can fluctuate significantly in a short period of time. It is important to invest only what you can afford to lose.

Table: Reasons for Bitcoin's Decline

| Reason | Impact |

|---|---|

| Interest rate hikes | Decreased demand for Bitcoin and other cryptocurrencies |

| Regulatory uncertainty | Investor hesitancy |

| Competition from other cryptocurrencies | Decreased demand for Bitcoin |

Conclusion

Bitcoin's decline has a number of potential implications, including a loss of confidence in the cryptocurrency market and a decrease in investment. It is important to note that Bitcoin is a volatile asset, and its price can fluctuate significantly in a short period of time. It is important to invest only what you can afford to lose.

The future of Bitcoin is uncertain. However, if it is able to overcome the challenges it faces, it could potentially become a mainstream asset class.